Danish Passenger Tax on Air Travel

Starting on 1 January 2025, the Danish Passenger Tax on Air Travel (Passagerafgift på flyrejser) will contribute to the green transformation and support the technological development of more sustainable aviation in Denmark.

What Is Danish Passenger Tax on Air Travel?

The Danish Passenger Tax on Air Travel applies to commercial flights from Denmark, excluding Faroe Islands and Greenland. Tickets or equivalent documents, such as coupon cards, rental contracts, or those granting access to hire or charter an aircraft, must be sold or issued on or after 1 January 2025. Taxable aircraft are those that are either certified for more than ten passenger seats or with a maximum permitted take-off weight of more than 5,700 kg (12,566 lbs). It falls under the regulation of the Danish Tax Agency Skatteforvaltningen (SKAT), which is the official body in charge of tax and duty collection in Denmark.

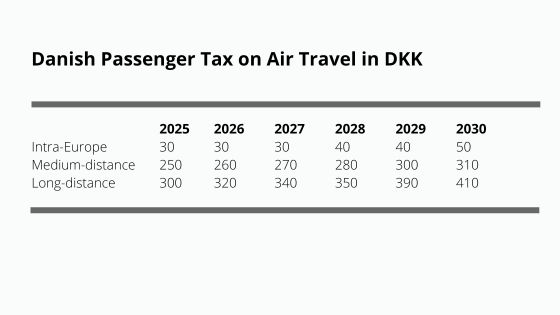

The tax rate per passenger varies based on the final destination of the journey and is set to rise annually until 1 January 2030. There are three categories depending on the destinations: Intra-Europe, medium-distance journeys, and long-distance journeys, to determine the specific tax rate.

Intra-Europe: Albania, Andorra, Austria, Belarus, Belgium, Bosnia Herzegovina, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, the Faroe Islands, Germany, Great Britain, Greece, Greenland, Hungary, Iceland, Ireland, Italy, Kosovo, Latvia, Liechtenstein, Lithuania, Luxemburg, Macedonia, Malta, Moldova, Monaco, Montenegro, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, and Vatican City.

Medium-distance Journeys: Afghanistan, Algeria, Armenia, Azerbaijan, Bahrain, Burkina Faso, Canada, Cape Verde, Chad, Djibouti, Egypt, Eritrea, Ethiopia, Gambia, Georgia, Guinea, Guinea-Bissau, Iraq, Iran, Israel, Ivory Coast, Jordan, Kazakhstan, Kuwait, Kyrgyzstan, Lebanon, Libya, Mali, Mauritania, Morocco, Niger, Oman, Pakistan, Palestine, Qatar, Russia, Saudi Arabia, Senegal, Sudan, Syria, Tajikistan, Tunisia, Turkmenistan, United Arab Emirates, United States, Uzbekistan, and Yemen.

Long-distance Journeys: All other countries that do not belong to the other two categories.

Who Is Liable for the Danish Passenger Tax on Air Travel?

The Danish Passenger Tax on Air Travel is levied on the aircraft operator with the commercial responsibility for the passenger’s flight, regardless of whether the aircraft operator has its own aircraft and crew, and whether the aircraft itself is rented, leased, or chartered. The two-letter code issued by the International Air Transport Association (IATA) usually identifies the airline with the overall responsibility. In case there is no IATA code, the liability falls on the registered owner at the time of the flight. For business jet charter operations, the responsible company is generally the one selling access and transports passengers from Denmark.

There are certain exemptions for specific flights and passengers, including the following:

- Military flights, government flights, ambulance flights, search and rescue flights, humanitarian flights, and police flights

- Infants

- Staff of aircraft operators on business trips

- Transfer and transit passengers if their journey continues on a connecting flight within 24 hours of departing from Denmark, provided both flights are on the same ticket.

What Are the Obligations?

As a participating aircraft operator, you must:

- appoint a fiscal representative (such as FCC Aviation) if you don’t have a fixed establishment in Denmark. The appointment is optional for companies with a place of business in another EU member state or in a non-EU country that has a mutual assistance for recovery agreement with Denmark, on par with EU rules. These non-EU countries include Great Britain, Northern Ireland, Norway, Iceland, the Faroe Islands, and Greenland.

- register the business with the customs and tax administration no later than 8 days before the first chargeable flight. Companies liable for tax from 1 January 2025 must ensure they register by 15 January 2025 at the latest.

- submit a tax declaration and pay tax by the 15th day of the month following the reporting month or until the next banking day in case the 15th falls on a bank closing day.

- maintain records, whether in physical or electronic form, which serve as the basis for tax calculations for 5 years after the end of the reporting year.